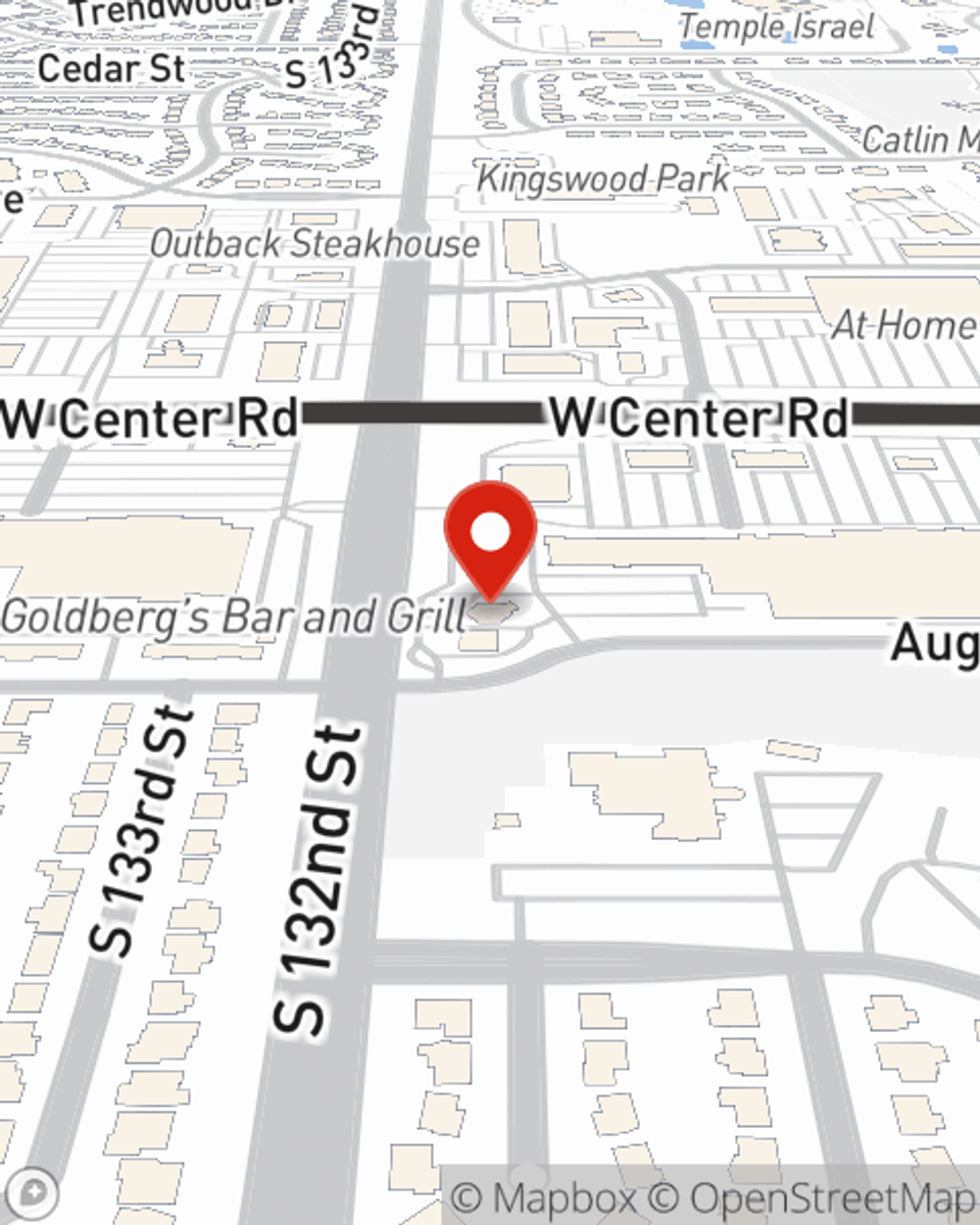

Business Insurance in and around Omaha

One of Omaha’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Omaha

- Gretna

- La Vista

- Papillion

- Elkhorn

- Millard

- Lincoln

- Council Bluffs

- Iowa

- Nebraska

- Kansas

- Colorado

- Douglas County

- Sarpy County

Help Prepare Your Business For The Unexpected.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or damage. And you also want to care for any staff and customers who get hurt on your property.

One of Omaha’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

With options like errors and omissions liability, business continuity plans, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Tanya Patzner is here to help you customize your policy and can assist you in submitting a claim when the unexpected does happen.

Don’t let fears about your business keep you up at night! Visit State Farm agent Tanya Patzner today, and learn more about the advantages of State Farm small business insurance.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tanya Patzner

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.